The cybersecurity industry is rapidly moving from standalone point solutions to integrated security platforms. These platforms combine tools such as endpoint protection, cloud-native security and automated detection and response technologies. What is driving this change and what does it mean for organisations?

TEXT:WILLIAM VISTERIN IMAGE: ENVATO

Organisations are working with ever fewer security vendors. Matthew Ball, chief analyst at market research firm Canalys, recently highlighted that around three-quarters of organisations plan to reduce the number of standalone security solutions they use over the next 12 months. This confirms research from analysts such as Gartner: the cyber security market is consolidating.

Four to five

This trend for consolidation and simplification among customers creates opportunities for cybersecurity platforms. ‘Such platforms should eliminate redundancies and enable an integrated approach,’ argues Ball. ‘However, the market remains fragmented, with each platform presenting itself as the solution for consolidation,’ he suggests.

Canalys predicts that only four to five platforms will eventually dominate the market for large enterprises and governments. However, Matthew Ball also sees a role for specialist vendors. ‘Start-ups and niche vendors are not disappearing, but integrating within larger platform ecosystems. Broad technology alliances and co-creation are essential for success,’ says Ball.

Cyber follows cloud and AI

Customers should change along with them, the analyst says. ‘Companies are adapting their IT architecture for the cloud and, more recently, for AI. They also need to redesign their cybersecurity to increase resilience and counter ransomware attacks,’ says Ball. ‘Vendors are positioning their cybersecurity platforms to reduce complexity for customers by consolidating redundant and obsolete point solutions. There is a lot to be said for this,’ he believes.

‘Fewer vendors means simpler management and less training for staff. It also saves money: one contract instead of several reduces costs and simplifies budgeting. In addition, Ball says, security platforms can provide better security. Integrated tools work better together, speeding up automation and detection. Fewer tools also mean fewer updates, reducing patching and the risk of misconfiguration.

Vendor lock-in

Despite the benefits of integrating such security platforms, challenges remain. Aggregating tools from a single vendor can create risks such as vendor lock-in and a lack of diversity in security solutions. There may also be quality differences, as not every feature within such a platform is best-in-class.

Finally, Ball also warns of the risk of a single point of failure, pointing to the problems at CrowdStrike. ‘Consolidation can undermine the resilience of organisations as they become more dependent on fewer vendors.’

These are the Cyber Titans

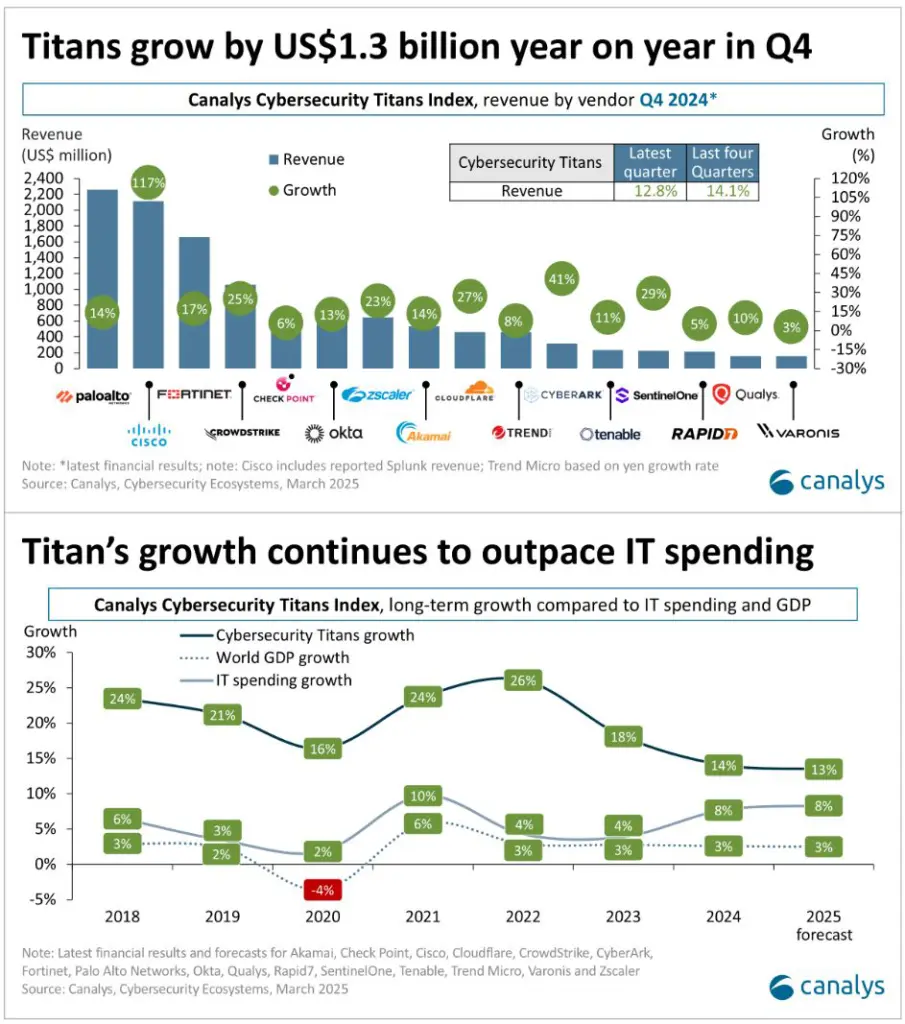

Palo Alto Networks, Fortinet, Microsoft, Cisco, CrowdStrike, Okta, Check Point and Zscaler are the leading names when it comes to security platforms. Almost all of them also appear in Canalys’ Cybersecurity Titan Index of leading security vendors. And this shows that these titans are growing faster than global IT spending.

SHARE THIS PAGE ON

CONTENTS

01

CYBERSEC E-MAGAZINE

Edition #08 – April 2025

02

EDITO & CONTENTS

Welcome to the capital of Europe

03

EVENTS

Why Cybersec is another must this year

04

AWARDS

Computable & Cybersec Awards at Cybersec Europe

05

ADVERTISEMENT

Cybersec Europe 2025: Is your organization secure?

06

WHAT THE HACK?!

1.5 billion crypto hack raises security questions

07

SECPRAC

Securing the future of ports: the Oulu initiative

08

ADVERTISEMENT

Lenovo: A smarter way to transform your business!

09

ANALYSIS

The rise of security platforms

SPECIAL CISO

10

SALARY

Salary CISO not commensurate with workload

11

CYBER TALENT

War on talent in cybersecurity: six key messages from the frontline

12

COOPERATION

Strong cooperation between CISO and board is a must

13

ADVERTISEMENT

RCDevs: A European answer to modern CISOs’ security challenges

14

IN-DEPTH

The dark side of automation and the rise of AI agents: a new challenge for cybersecurity

15

ADVERTISEMENT

Cybersec Netherlands strengthening partnership with Security Delta (HSD)

16

BLOG

3 Steps to an Identity Security Strategy